Eqva ASA is a knowledge-based active owner of industrial service companies that contribute to the green transition in maritime, power intensive and renewable industries.

The group has a well-diversified product and market portfolio. Further growth and value creation will be obtained through a combination of industrial excellence in each portfolio company, synergies between the companies in the group and targeted M&A activities.

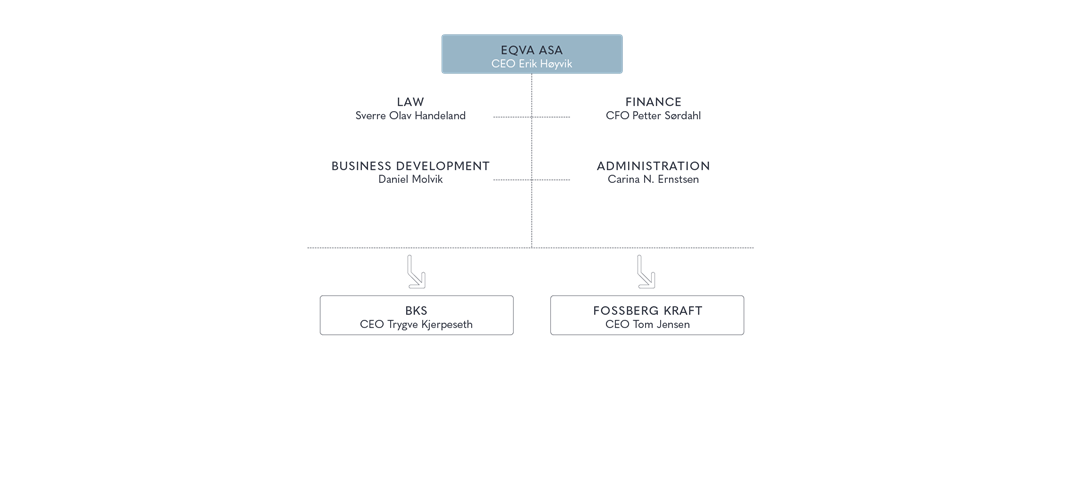

Key companies in the group are BKS and Fossberg Kraft, each building on decades of experience and widely recognised by clients in a broad range of industries.

Strategic priorities

The race towards carbon neutrality is on, and customers are turning to Eqva for help. Digital solutions and green technology are needed and included in new projects and retrofitted in existing production assets and plants. This creates an unprecedented demand for industrial services, which our portfolio companies are well equipped to meet through their market leading positions and focus on service and high quality in each delivery. In total this provides a strong foundation for profitable organic growth.

The transformation of industries and the new business models that emerge create opportunities for consolidation and re-engineering of industrial service companies themselves. Eqva is well placed to take the lead in such transformation. It is a responsible owner with an eternal investment perspective, and it aims to maximise financial return over time.

Eqva is supported by highly committed owners and powered by experienced investment professionals and industry leaders. Our portfolio companies have earned the trust of their customers through decades of successful deliveries, on time and within budget. Together we take pride in delivering value to our shareholders by delivering the best possible service to our customers.

Eqva’s financial targets for 2024

- NOK 600-700 million in revenue

- 5-7 per cent EBITDA margin

Eqva has set a long-term EBITDA margin target for the group, ranging between 7 to 9 per cent.

Click here to see our latest investor presentation